Not long ago, wallets were leather, filled with crumpled bills, shiny cards, and a few forgotten receipts. Today, the modern wallet is invisible — it lives in your smartphone, powered by data, code, and connectivity.

We’re stepping into an era where cash is fading, and digital wallets have become the new financial heartbeat of daily life. Whether it’s paying for coffee with Apple Pay, transferring funds through PayPal, or storing crypto on Binance, money is no longer just physical — it’s digital, borderless, and instant.

But here’s the truth: the digital wallet revolution has only just begun.

As blockchain, AI, and fintech innovation collide, digital wallets are evolving far beyond payment tools — they’re becoming financial ecosystems, digital IDs, and even gateways to Web3. In 2025 and beyond, they’re redefining how we save, spend, and trust money itself.

💳 What Is a Digital Wallet?

A digital wallet (also called an e-wallet) is a software-based system that securely stores users’ payment information and passwords for multiple payment methods and websites.

In simple terms, it’s your entire financial life in one app — letting you send, receive, invest, and store value with just a tap.

Popular digital wallets include:

- Apple Pay and Google Wallet – mobile payment platforms for contactless transactions.

- PayPal, Venmo, and Cash App – online transfer and peer-to-peer (P2P) apps.

- MetaMask, Trust Wallet, and Coinbase Wallet – gateways to cryptocurrencies and NFTs.

But unlike traditional wallets, these aren’t just storage tools — they’re mini-financial platforms that merge banking, identity, and investment.

💰 From Cash to Code: The Shift Toward Digital Finance

The journey from cash to crypto didn’t happen overnight. It’s the result of decades of technological evolution — a perfect storm of convenience, connectivity, and consumer demand.

Let’s trace the evolution briefly:

The Cash Era – Physical money dominated for centuries.

Tangible, trusted, but limited by geography and safety concerns.

The Card Revolution – Credit and debit cards made payments faster.

Plastic replaced paper, enabling the rise of global commerce.

Online Banking & PayPal (1990s–2000s) – The first digital financial interactions.

Money began moving online, but still under traditional systems.

Mobile Wallets & Contactless Payments (2010s) –

Apple Pay, Samsung Pay, and Alipay introduced tap-to-pay convenience.

Crypto & Blockchain (2017–present) –

Decentralized money transformed digital wallets into private banks and digital vaults.

Each step brought us closer to financial freedom and digital empowerment. In 2025, the trend has reached a tipping point — and there’s no going back.

🌍 Why the Digital Wallet Revolution Matters

The rise of digital wallets is more than a tech trend — it’s a global financial transformation.

Here’s why it’s reshaping economies, businesses, and human behavior:

⚡Speed and Convenience

With a single tap or scan, users can pay for goods, send money globally, or invest in stocks and crypto — all in seconds. No more waiting for bank transfers or carrying cash.

🔒Security and Encryption

Biometric authentication, tokenization, and blockchain technology make digital wallets far more secure than traditional payment methods.

🌐 Financial Inclusion

Digital wallets give access to financial tools to millions who were previously unbanked. In countries like Kenya, Nigeria, and India, mobile money has brought economic independence to remote populations.

💡 Integration with Digital Life

From ride-sharing to e-commerce, wallets are now built into the apps we already use daily. Payments have become seamless, invisible, and frictionless.

💹 Crypto Compatibility

Many wallets now support cryptocurrencies, allowing users to hold, trade, or stake assets directly — blurring the line between banking and blockchain.

The result? A world where money moves as fast as information — instant, digital, and decentralized.

🔗 The Blockchain Connection: Powering the Next Financial Wave

At the heart of the digital wallet revolution lies blockchain technology — the decentralized ledger that enables cryptocurrencies and secure peer-to-peer transactions.

Unlike banks, which rely on intermediaries, blockchain allows money to move directly between people — verified by code, not institutions.

🧠 Why Blockchain Matters for Wallets

- Transparency: Every transaction is recorded and traceable.

- Decentralization: Users control their funds without third-party interference.

- Programmability: Smart contracts automate payments, lending, and investments.

In 2025, this technology is evolving beyond crypto trading. Blockchain wallets now integrate with decentralized finance (DeFi) platforms, allowing users to:

- Earn interest through staking and yield farming.

- Access decentralized loans.

- Buy NFTs and digital assets securely.

In short, your digital wallet is becoming your gateway to the decentralized internet — Web3.

🏦 Central Bank Digital Currencies (CBDCs): Governments Join the Game

The rise of cryptocurrencies forced governments to act. To stay relevant and maintain monetary control, many are now developing CBDCs (Central Bank Digital Currencies) — digital versions of their national currencies.

Countries like China (Digital Yuan), India (e₹), and the EU (Digital Euro) are already experimenting with CBDCs, while others prepare to follow.

🔍 Why CBDCs Matter

- They combine government-backed stability with digital speed.

- Reduce the need for physical cash printing.

- Enable instant, traceable payments between citizens and states.

CBDCs will integrate directly into national digital wallets, transforming everything from taxation to welfare distribution.

The global impact? A hybrid financial future, where traditional finance and crypto ecosystems coexist — each influencing the other.

🧠 AI and the Smart Wallet Evolution

The next big leap in the digital wallet revolution is artificial intelligence.

AI is making digital wallets smarter — not just places to hold money, but intelligent assistants that analyze spending, optimize budgets, and predict financial behavior.

Imagine this:

- Your wallet automatically suggests saving strategies.

- It alerts you when you’re overspending or identifies risky transactions.

- It offers custom investment options based on your goals.

In 2025, this isn’t imagination — it’s reality. Platforms like Cleo, Wallet.ai, and Digit already use machine learning to automate savings and financial advice.

AI-driven wallets are helping users make smarter, data-backed decisions, democratizing access to financial intelligence once reserved for the wealthy.

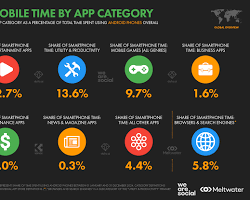

🛒 E-Commerce and the Wallet Economy

Digital wallets are also revolutionizing how we shop.

E-commerce giants like Amazon, Alibaba, and Shopify integrate digital wallets for seamless one-click purchases. Meanwhile, Buy Now, Pay Later (BNPL) models — offered by companies like Klarna and Afterpay — give consumers flexible, interest-free spending options directly through their digital wallets.

The result?

- Fewer abandoned carts.

- Faster checkouts.

- A personalized shopping experience.

But it’s not just about convenience — it’s about data. Retailers gain deeper insights into consumer hbits, while wallets evolve into powerful marketing tools.

🌱 The Rise of Crypto Wallets

Crypto wallets are no longer niche — they’re essential for millions of users investing in digital assets.

🪙 Two Main Types of Crypto Wallets

Hot Wallets (online, connected to the internet)

- Examples: MetaMask, Coinbase Wallet, Trust Wallet.

- Pros: Easy access and real-time trading.

- Cons: Higher risk of hacking.

Cold Wallets (offline, hardware-based)

- Examples: Ledger, Trezor.

- Pros: Maximum security.

- Cons: Less convenient for daily use.

In 2025, the next generation of crypto wallets merges both — hybrid systems offering security + flexibility, with features like biometric access and multi-chain compatibility.

These wallets aren’t just for traders; they’re for anyone who values independence, ownership, and control over their digital wealth.

🌐 Global Inclusion: Digital Wallets Empowering the Unbanked

One of the most powerful impacts of digital wallets is financial inclusion.

According to the World Bank, over 1.4 billion adults worldwide remain unbanked — unable to access traditional banking systems. But thanks to mobile technology, many now use digital wallets as their first financial account.

In Africa, Asia, and Latin America:

- M-Pesa (Kenya) allows people to save, borrow, and pay digitally without a bank.

- GCash (Philippines) enables financial transactions through mobile phones.

- bKash (Bangladesh) brings digital finance to rural areas.

This revolution isn’t just about convenience — it’s about economic empowerment. Digital wallets give people access to credit, savings, and insurance, breaking cycles of poverty and exclusion.

⚖️ Challenges Ahead: Security, Privacy & Trust

For all its progress, the digital wallet revolution isn’t without risks.

⚠️ Major Challenges Include:

Cybersecurity Threats – Hackers target wallets and exchanges to steal funds.

Privacy Concerns – Data collection and tracking raise questions about surveillance.

Regulatory Uncertainty – Lack of global standards makes cross-border payments complex.

Digital Divide – Not everyone has smartphones or internet access.

To ensure a fair financial future, governments, tech companies, and consumers must work together to create secure, transparent, and inclusive systems.

Trust will be the true currency of tomorrow.

🧭 The Future of Digital Wallets: Beyond Money

In the next decade, digital wallets will evolve beyond payments — becoming digital identities, passports, and financial dashboards.

Imagine a single app that:

- Stores your ID, medical records, and crypto assets.

- Connects to your bank, employer, and favorite apps.

- Uses blockchain to verify your identity without revealing private data.

This fusion of identity + finance + technology will redefine what it means to “own” something in the digital world.

Your wallet won’t just carry your money — it will carry your digital life.

💬 Conclusion:

From cash to crypto, the digital wallet revolution has already changed how we think about money. But in truth — this is just the beginning.

We’re witnessing the birth of a global digital economy — one where finance is decentralized, data-driven, and human-focused.

As blockchain, AI, and fintech continue to evolve, wallets will become the nexus of trust, identity, and opportunity. They’ll empower the unbanked, connect global markets, and reshape wealth as we know it.

The future belongs to those who can adapt — not just by using digital wallets, but by understanding the power they hold.